We are living in an era of digital revolution: artificial intelligence, metaverse, digital twins, process automation… These and many other technologies are enabling the transformation of companies and businesses.

But, paradoxically, while organizations are revolutionizing many of their departments with these technologies, they are still using spreadsheets in the finance area. Is it possible to transform a finance department by keeping Excel?

In this article we want to talk to you about what it means to achieve a real digital transformation in finance departments and how you can achieve it in your organization.

What do we call financial digital transformation?

Digital transformation refers to the application of digital technology to improve and transform financial processes and operations. These technologies encompass Artificial Intelligence (AI), automation, the cloud, advanced data analytics, etc.

To take full advantage of the capabilities of these technologies, it is advisable to replace obsolete tools (such as spreadsheets) with others that are current and in many cases tailored to the needs of each organization.

Why is the digital transformation of the financial area necessary?

Digitalization is something that many organizations have already successfully applied to other areas of their businesses. However, the financial area, although it is a strategic area for decision-making, is not always a priority in these transformation processes.

Any organization considering a digital transformation process must include its finance and controlling teams, as they are the ones who have a global vision of the business and connect with the rest of the company’s areas.

In the same way that production and supply chain benefit from state-of-the-art ERP applications, or sales is helped by a CRM, finance teams should have more than just Excel.

It is true that we owe a lot to spreadsheets, but we all know that there comes a time when we have to leave them behind: they create islands of information, are time-consuming, lack powerful analytical capabilities, generate a multitude of errors when working on them in a collaborative way?

Today there are alternatives that offer more and better features and can save a lot of time for financial teams thanks to the integration of new technologies.

Pillars for financial digital transformation

Every organization is unique, but there are 5 pillars that should be taken into account in most digital transformation processes of financial departments. Let’s take a look at them.

Centralizing data on a single platform

According to a study by Constelation Research on the use of planning platforms, organizations that do not have their data centralized spend 20% of their “Planning and Analysis” time on data collection alone, and another 30% on data validation.

Cloud solutions that centralize data, in addition to saving that time, are more flexible and can easily scale as the organization grows. They also allow you to create a collaborative environment where any user can work in real time from any location or device, which is necessary in a job market where remote work is so important.

The more spreadsheets that are shared within an organization, the greater the likelihood of human error (conflicting copies, lack of data integrity, etc.), which feeds the vicious cycle of spending even more time reviewing and validating data.

Free up team time by automating processes

Doing a manual financial consolidation from data from dozens (or hundreds) of spreadsheets, tracking every file and every version that has been emailed, is a hell that many CFOs are familiar with and wish they never went through again.

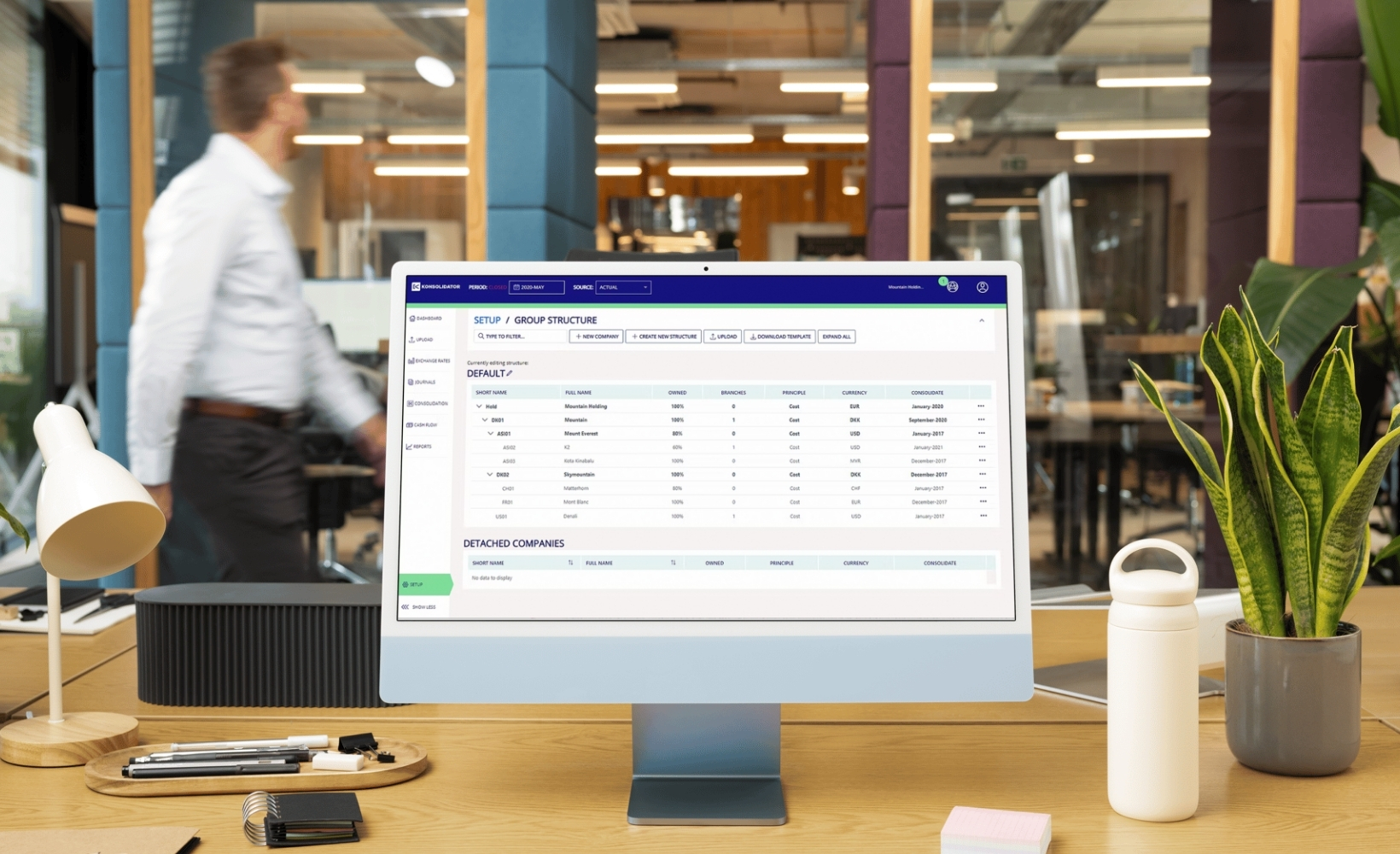

Financial software allows automation of many key processes, financial consolidation being one of them. Data is automatically collected from ERP and other sources, freeing up a significant amount of time that finance teams can spend on strategic tasks such as simulating scenarios, analyzing group financial performance or discovering intra-group cost optimizations.

Manual spreadsheet consolidations are not only inefficient in terms of time, but are a major source of financial errors, which can negatively impact your business.

Data optimization to facilitate decision making

Collecting and centralizing data is only the beginning of the journey, because data is useless if it is not translated into information that facilitates decision making.

Finance managers have to make many important and, in many cases, urgent decisions. Having an optimized system that provides clear, real-time reports facilitates this task, as well as the security that comes from being able to make those decisions with the confidence that the information available is accurate and current.

In this sense, spreadsheets have many limitations, as they were not really designed for complex tasks such as managing a business, but rather for performing simpler mathematical operations.

Ability to perform powerful predictive analytics

Predictive analytics can identify trends and patterns in historical data, which, reinforced with artificial intelligence and machine learning algorithms, enables highly accurate forecasts.

This reduces the time required to perform important processes such as income statement planning or balance sheet and treasury planning, improving the productivity of teams and the accuracy of plans.

Performing financial planning in a specialized tool helps you to shorten deadlines based on an initial forecast from a predictive algorithm. It also allows you to make changes to that forecast and re-forecast by modifying budgets in real time, combining AI data with key insights from the finance team.

These same procedures in spreadsheets require much more time and dedication. In fact, they can become a heavy burden that limits changes and updates, requiring almost full dedication from the teams.

Obtain more agile and robust financial planning processes

The purpose of digitization is to achieve more agile and efficient processes, and this is achieved when everything we have seen in the previous points comes together. Having a tailored solution that brings together these features offers certain advantages that other means, such as spreadsheets, cannot.

Financial software:

- They always make plans and forecasts incorporating all data, which offers greater agility and continuity.

- They include data from the entire business in a centralized way, allowing a better understanding of the entire activity.

- They enable collaboration across all teams, making it easier for all parties to access and use the same information, creating forecasting scenarios that can include approval workflows.

Continuing to use spreadsheets may be more economical in direct costs, but in doing so you pay a price that is not always taken into account: loss of data, human errors, time invested by the teams, etc.

Holistic Data Solutions: we put technology at your service

Financial software is a flexible solution, allows greater transparency, is more collaborative and is able to provide more accurate planning in less time.

The silos of information produced by spreadsheets are a thing of the past. Finance teams today have other needs, which must be met with tailored solutions that enable them to make better decisions and, therefore, achieve better results for the business.

If you would like to learn more about how these types of financial software solutions can help your organization, please do not hesitate to contact us.

Related Articles

In a context like the current one where financial instability and market volatility are so present, it is normal that [...]

Board International was founded in the 1990s with the aim of being a Self-Service Analysis and Reporting, which goes through [...]

Time and money. If we were to carry out a market survey and ask finance directors, entrepreneurs or heads of [...]