In a context like the current one where financial instability and market volatility are so present, it is normal that every day more and more companies want to improve their Financial Planning and Analysis (FP&A). In this article we would like to explain what FP&A is and go deeper into its importance for your organization.

What is FP&A: Financial Planning and Analysis.

FP&A is the acronym for Financial Planning and Analysis.

Financial planning and analysis are the forecasts on the financial statements of the company as a whole (Income Statement, Balance Sheet, Treasury, Cash Flow), as well as the comparisons and analysis of the current situation with respect to the historical or the performance of the company over the previous forecast.

Financial planning and analysis support the organization’s business and financial decision making. Forecasting also provides a snapshot to management on the evolution of the organization’s strategic plans and investments.

Therefore, FP&A planning is about optimizing financial management, assisting executives in decision making and giving way to a strategy based on reliable and objective data.

For many, many years, finance professionals have used Excel templates as an analysis tool. However, with the evolution of new technologies, this procedure has become somewhat obsolete.

Today there are much more specific alternatives to spreadsheets: platforms designed to plan and simulate (Financial Planning, FP) or to analyze and make decisions (Analysis, A, thanks to Business Intelligence).

How is a FP&A process carried out?

Broadly speaking, FP&A is based on four pillars: financial planning, scenario estimation, budgeting and monitoring, and management reporting.

These 4 major tasks are performed on a cyclical and continuous basis. The frequency with which it is done and the complexity involved in its execution will depend on each company and context. For example, in times of rapid change or greater volatility, it is advisable to increase the frequency of these analyses. The difficulty also increases because the number of variables to be taken into account increases.

Let’s see in detail what each of these parts involves.

Starting point: data collection.

The first task is to collect and verify data from different sources, both internal to the company (financial and operational data, ERP data, etc.) and external (global or sectoral economic data, demographic data, etc.).

This is a very important phase since the plans and estimates generated will depend on the quality of this data. This makes it a task that requires a heavy investment in time, so it is increasingly common to opt for solutions that incorporate Artificial Intelligence and machine learning to reduce data collection times.

Financial planning.

The next step is the use of all the data collected to prepare estimates or financial projections for the company, a job performed by FP&A’s team of analysts. It is usual at this point to test multiple scenarios to study how the different variables behave in them and thus determine which is the best strategy to follow.

In this sense, there are different types of methods to carry out the planning according to the data and technology available, among which are:

- Predictive financial planning: based on large historical data sets.

- Driver-based financial planning: based on the main assets or drivers of the business.

- Multi-scenario financial planning: based on different assumptions about the future.

In any case, the result of this step will be the creation of a financial and operational plan that will help achieve the business objectives.

Budget elaboration.

The budget establishes the expenses and investments necessary to execute the plan established in the previous phase, based on the available income. This makes it possible to define the items allocated to each department or business unit as well as the return expected from them.

Follow-up and management reports.

Another of the tasks of FP&A’s team of analysts is the monitoring of all the indicators related to the financial plan. This allows the creation of periodic reports so that the managers have information on how the actions and results are evolving, and based on this, take new decisions.

FP&A professionals.

As we have seen, the Financial Planning and Analysis team has an important role in the whole process, as it could not be otherwise. They must also be in frequent contact with all areas of the company: operations, marketing, sales, accounting, treasury, among others.

The team usually reports to the CFO (Chief Financial Officer), who usually makes strategic financial decisions.

As we have seen, the main responsibilities of the FP&A team include the following:

- Connect high-level strategy with operational plans through the preparation of annual budgets.

- Perform short and medium term projections that facilitate the definition of action plans based on the organization’s high-level objectives.

- Advise management on how to improve performance, minimize risk, detect new opportunities, etc.

- Monitor and analyze the company’s current results.

- Participate in mergers, acquisitions, market research, process optimization, divestitures, etc.

All these tasks, or many others performed by the team, require the management of large amounts of data. This requires them to use everything from more or less complex spreadsheets to more specialized software that allows the automation of tasks for greater efficiency.

How to improve the performance of the FP&A team.

The biggest difficulty in improving the efficiency of FP&A processes is the proper collection and processing of data. As the size of the organization increases, the number and complexity of information sources makes it virtually impossible to perform this task without support from the IT department, but they do not always provide solutions in a timely manner.

Having to bridge these gaps with manual information processing makes the process much slower and tedious, and increases the likelihood of errors. All this directly affects the efficiency of the company’s financial management.

The solution is to invest in software suited to the company’s financial planning and analysis needs. The cost of not doing so may in many cases be higher than the investment required for this type of solution. Just think of the cost of the time lost by your team in performing repetitive and manual tasks.

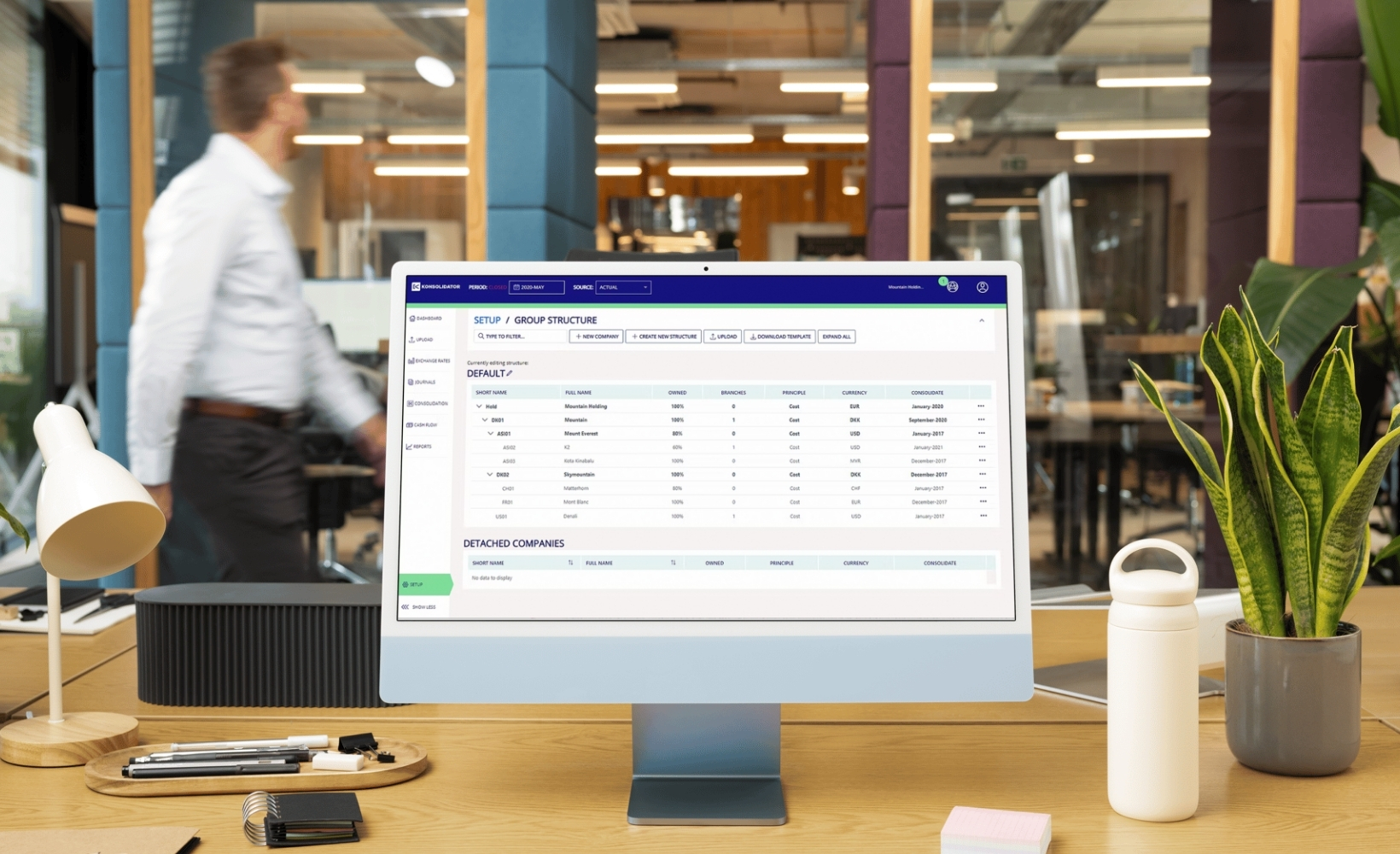

A good FP&A software helps to improve the efficiency of the work performed by the whole team in a direct way: they will have accurate information in real time, arranged in a more user-friendly way for processing compared to what an Excel can offer, and with the possibility of creating more useful, fast and accurate reports for both the CFO and the board.

Importance of financial planning and analysis.

A company can hardly grow without improving its financial management. Knowing its current state, defining the best strategy according to its own data and those of the environment, defining appropriate budgets, etc. It is essential to have a good system that facilitates the processes of financial planning and analysis.

In addition to the above, FP&A brings other benefits such as:

- It predicts the possible risks to which the business is exposed, designs an action plan based on the forecast, and determines what action to take according to the new needs of the future.

- It improves decision making based on reports and financial data taken in real time. This, in a changing and volatile context, is key for the teams of the different departments to be able to redirect deviations from budget and results.

- Make revenue projections to adapt to current conditions and plan new actions to optimize business performance.

- Analyzes whether resources are being invested according to plans, and what their availability is, both now and in the future.

- Reviews and studies commercial processes to identify whether they are achieving the objectives set in terms of budgets and profitability.

- Monitors cash flow in real time, to keep up to date with revenues and verify that financial planning is being met.

- Measures all the tangible assets of the company, beyond cash. For example, machinery, stock, credit assets, etc. In this way, it is possible to assess whether it is advisable to make them liquid or not.

- Constantly studies the financial profitability of each department and of the company as a whole, to determine what should be boosted.

- Carry out comprehensive financial and economic projections.

These are just some of the many benefits of financial planning and analysis in a company. FP&A data analysis is about seizing opportunities as well as avoiding risks that could lead to a business crisis.

In short, financial planning and analysis provides access to key information at a corporate level, thus facilitating decision making throughout the company.

Software as a FP&A solution.

We have seen that financial planning and analysis has a multitude of business benefits, but tackling it manually is a complex and error-prone process.

While Excel spreadsheets are still the go-to tool for many finance teams, organizations are facing increasing data volume and process complexity. Managing this constant variability at a high level of detail is very difficult in Excel, where you end up with manual errors, data inconsistency or loss of information.

Even if we have highly qualified people who hardly make any mistakes when performing the operations, the question is: what is the cost of all the time spent by financial experts in performing such analyses?

We are in an era of digitization at all levels, and finance is also one of them. Having an FP&A software tool that is able to automate and optimize financial planning and analysis is something that can generate a lot of value for companies.

An FP&A solution significantly improves the management of the financial department because it allows them to have a continuous forecast in a fast, agile, transparent and much more dynamic way.

In this way, leaders will be able to have information on the financial situation of the organization at all times, which in turn will allow them to make the best decisions based on real business data.

Conclusion.

As companies continue to grow into more dynamic and larger versions, financial forecasting will become increasingly difficult, either because of an increase in business or because of the growing amount of information needed to build the forecasting model.

However, by implementing a continuous forecasting and analysis process using FP&A solutions, companies will be better prepared to meet the challenges with a higher probability of success.

FP&A software enables finance departments to extract valuable information quickly and accurately, obtain data efficiently and in real time, automate many tasks, and work in an integrated way with other business tools such as ERP or CRM used at the corporate level.

A sound business strategy requires reliable financial management. This requires a specialized FP&A solution. If you want more information please contact us and we will answer all your questions in a personalized way.

Related Articles

Board International was founded in the 1990s with the aim of being a Self-Service Analysis and Reporting, which goes through [...]

Time and money. If we were to carry out a market survey and ask finance directors, entrepreneurs or heads of [...]

Finance is a vital area for any company. In a context marked by instability and volatility, it is more important [...]