The income statement (P&L) is one of the most widely used financial reports by companies when planning their business. In this article we want to explain what it is, how it is obtained and we also offer you some valuable keys to get the most out of your P&L planning.

What is P&L (profit and loss)

P&L is the acronym for Profit and Loss, which in English we usually call the profit and loss statement or the balance sheet.

Whatever it is called, this report shows all the company’s expenses and income (and therefore the economic results) for a given period, with a monthly or cumulative view.

The planning of income and expenses is one of the main references for monitoring the business. During the year, it will make it possible to check whether it is progressing according to plan or whether there are deviations that require action to be taken.

The importance of profit and loss planning

The importance of the P&L lies in the fact that, unlike other reports, it does not show a static picture of the company or a snapshot of a specific moment in time. The P&L shows how the company has evolved over a period, or how it is intended to evolve (if we are talking about planning).

For this reason it is one of the most important financial documents to ensure the growth of your business. It helps you not to stray from your month-to-month plan, to have accurate accounts of purchases and sales for each period, and to accurately assess the company’s profitability.

How to plan your company’s P&L

There are many articles on the web that talk about how to create the P&L, with steps, guides and even generic templates. Here we do not want to develop another step-by-step guide, but to show the approach we have in Holistic Data Solutions when it comes to P&L planning.

Roughly speaking, the phases to perform the P&L calculation are:

- Calculate all income and expenses to obtain the Operating Income (Income – Expenses).

- If you have financial assets, you must also calculate the income and expenses they generate to obtain the financial result.

- The sum of the two previous ones is the Profit before taxes.

- After applying the corresponding taxes, the Profit or Loss for the year is obtained, where you can see the company’s profit or loss once taxes have been deducted.

When it comes to profit & loss planning, the key is to make a correct estimate of income and expenses.

Something that at first sight may seem very simple (sales forecast and expenses forecast) can be complicated by a multitude of factors: lack of previous information, failures in the estimate, changes in the context, etc.

To obtain the best results in P&L (profit and loss) planning, take into account the following aspects.

Keys to improve your P&L planning

P&L planning should be collaborative

As a company’s information is disaggregated, a more accurate estimate can be made. The heads of each department have very detailed information about the expenses and revenues for which they are responsible.

Taking this information into account is essential for the company’s overall profit and loss statement to be accurate.

Take into account the different lines of business

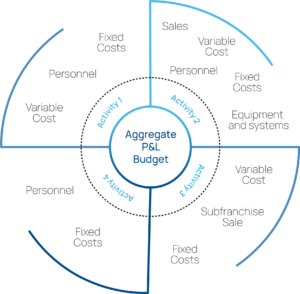

If a company has several lines of business with different P&L, it is advisable not only to prepare the income statement for each of these lines, but also to prepare the aggregate income statement for the company.

Take into account the nature of each heading when making the estimate

Not all costs and revenues behave in the same way, so grouping them together and treating them differently makes it possible to obtain a better estimate. This involves dividing the income statement into different headings such as personnel costs, variable costs, fixed costs, sales of products, sales of services, etc.

Each of these groups can be treated with a specific forecasting model that best suits its nature. This allows more accurate estimates to be made, which provides better information to managers and decision-makers.

For example, when planning a P&L for a catering company with a large number of locations, the breakdown could follow a scheme similar to this one:

From planning to P&L monitoring

Once this planning is in place, comparisons of actual and planned data can be made periodically during the year and any deviations can be monitored.

From time to time a Rolling Forecast can be made to indicate whether any changes in the planning are necessary to improve the results. In this way the P&L planning will remain useful and representative throughout the year.

P&L planning and monitoring allows companies to focus on 3 key aspects:

- The company’s growth, both in terms of turnover and profits.

- The cost structure, providing a good view of the real distribution of costs, facilitating the estimation of operational risks.

- Real profitability, since it may be the case of having revenues but “selling at a loss”.

Tools for good P&L planning

Having tools that allow for quick and accurate P&L information helps companies to manage their resources more efficiently and to have a very clear view of the impact of purchases and sales on the health of their business.

Information is power, as long as it is available in a timely manner to assist in decision making. There are generic solutions that, although they allow you to gather this data, do not provide information in an efficient way. The ideal is to have a specific system to plan your P&L to help you make better decisions for your company.

At Holistic Data Solutions we can help you to adopt financial software solutions adapted to your needs. If you want more information just contact us.

Related Articles

In a context like the current one where financial instability and market volatility are so present, it is normal that [...]

Board International was founded in the 1990s with the aim of being a Self-Service Analysis and Reporting, which goes through [...]

Time and money. If we were to carry out a market survey and ask finance directors, entrepreneurs or heads of [...]