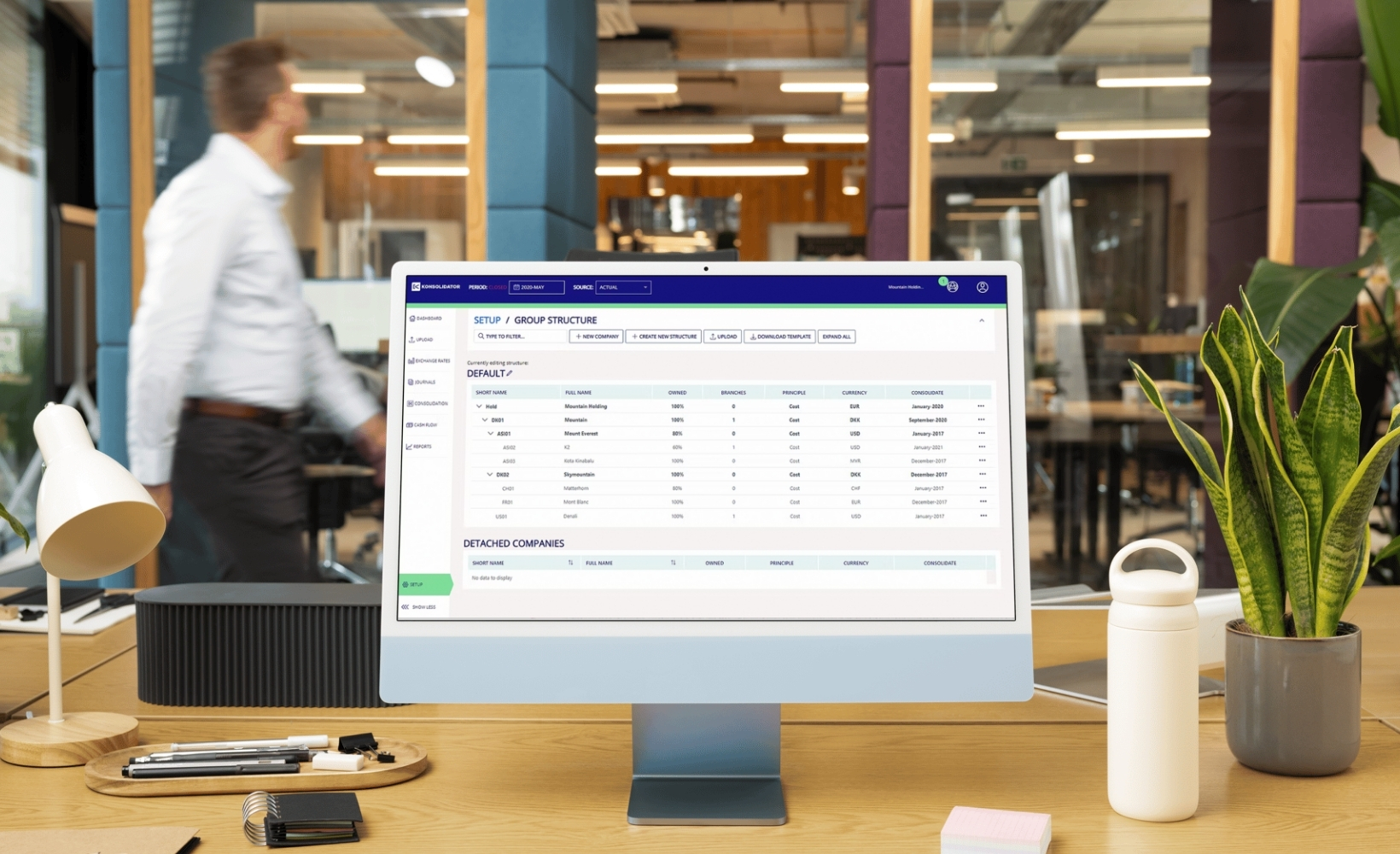

Konsolidator: optimize financial consolidation easily and efficiently

The financial consolidation process is often a challenge for CFOs and financial controllers: it often involves a significant investment of time, effort and resources, frequent errors appear that require more time to correct, or even worse, that go undetected and end up in the final reports. Avoiding this situation is easy with Konsolidator.

In this article we talk about Konsolidator software, a tool focused on improving financial consolidation processes so that they can be performed quickly, accurately and easily, without sacrificing quality.

What exactly is Konsolidator?

Konsolidator is a financial consolidation software that has been developed by former Danish CFOs who know first-hand the challenges of this process. In other words, it is a solution created by CFOs for CFOs (and other finance staff).

And by the way, a relevant fact: the company is still run by its original creators, which ensures that its added value and practical approach for finance teams remains 100% in its DNA.

It is a 100% cloud software-as-a-service (SaaS) platform, so no local installations are required and its consolidation functions can be accessed directly from the browser.

The keys to Konsolidator: simplicity and efficiency in financial consolidation.

Simplicity and efficiency are two qualities that you can breathe in every pore of Konsolidator: the setup is simple, it can be connected to your ERP and allows you to automate data collection directly from the system so that you can carry out the consolidation process in a few minutes. That’s it.

Say goodbye to wasting time gathering information from each department, setting up spreadsheets to get the numbers you are looking for or tracking errors or figures that you don’t know where they come from.

Konsolidator’s main goal is to be an efficient, yet intuitive and easy-to-use financial consolidation tool that is within the reach of any organization, regardless of its size.

Main features of Konsolidator.

If we have to highlight some features of this tool, they would be the following:

- 100% in the cloud (SaaS): no need for installations and accessible from any browser.

- Focus on CFOs and controllers: it is a solution designed by former CFOs to respond to the real needs of finance teams, prioritizing usability in a precise and uncomplicated way.

- Automation of the consolidation process: includes automation options to reduce process times and manual errors.

- Simple and transparent pricing scheme: with options for companies looking for an effective yet accessible solution, with clear pricing and no hidden costs.

What Konsolidator can offer to CFOs and financial controllers.

Automating the financial consolidation process offers multiple advantages, as we have told you before in our blog. That is why below we mention the specific advantages that Konsolidator can offer to finance teams.

- Time savings and error reduction: thanks to its automation system, Konsolidator speeds up the consolidation process and minimizes the margin of human error.

- Centralized data in a single source: its data warehouse allows instant access and sharing, avoiding conflicts due to the use of disparate data.

- Transparency and traceability: allows you to track every figure and adjustment with a complete audit trail.

- Easy to integrate with your ERP: compatible with a multitude of ERP systems such as Microsoft Business Central 365, Xero, Sage, QuickBooks, and Exact.

- Intuitive and constantly evolving interface: the platform is under continuous development, ensuring that Konsolidator’s features are kept up to date with the latest market needs.

- Adaptability to tighter budgets: ideal for companies with limited budgets, it is a robust solution without the need for large investments in software or infrastructure.

For CFOs and financial controllers, Konsolidator represents an opportunity to optimize their consolidation processes, reducing associated costs and ensuring compliance with all financial requirements.

Consolidation of groups and subgroups in Konsolidator includes:

- Automated consolidation of actual, budget and forecast figures, including:

- Profit and loss, including segments, business units or product lines.

- Balance sheet

- Financial and operational indicators

- Cash flow statements of subsidiaries, subgroup and parent company

- Intercompany eliminations

- Elimination of investments in subsidiaries

- Calculation and elimination of minority interests

- Currency translation and exchange rate adjustments

Expansion and presence of Konsolidator in the Iberian Peninsula.

Konsolidator has a solid presence in Scandinavian markets such as Denmark and Sweden, where this solution has proven its effectiveness in demanding and competitive markets, although it is also present in the UK, Holland and Germany.

This 2024, the company has expanded its reach into the Iberian market, opening operations in Spain and Portugal, thus consolidating its commitment to bring its innovative financial consolidation tool to new audiences. Holistic Data Solutions has teamed up with them as a partner to include this solution within our portfolio of services and products.

Holistic Data Solutions: we help you automate your financial consolidation process.

Do you want to know how Konsolidator can fit your company’s needs? At Holistic Data Solutions, as Konsolidator partners, we are here to advise you and provide you with all the information you need about this financial consolidation software.

This is an interesting option for small or medium-sized companies looking to optimize their consolidation process, complying with all the regulations but without the need to take on more complex and costly comprehensive financial solutions.

Contact us for more information and take the next step towards a more efficient and affordable financial consolidation.

Related Articles

In a context like the current one where financial instability and market volatility are so present, it is normal that [...]

Time and money. If we were to carry out a market survey and ask finance directors, entrepreneurs or heads of [...]

Finance is a vital area for any company. In a context marked by instability and volatility, it is more important [...]