Financial planning and analysis (FP&A) are critical components of business management. These processes enable organizations to assess their financial performance, plan for the future and make informed decisions based on accurate data.

Broadly speaking, FP&A includes forecasting the entire company’s financial statements, creating budgets, and benchmarking performance against historical or previous forecasts.

While these principles are applicable to all industries, they are critical in the hospitality industry. The reason: its dynamic and changing nature makes the agility and accuracy of financial planning particularly crucial.

Why is FP&A important in the hotel industry?

In the hotel industry, it is essential to have the ability to quickly adapt planning to changes in strategy, market positioning and investment plans.

Annual planning, together with rolling forecasts in the short term, allows hotels to adjust their strategies to respond in real time to the environment, while keeping in line with the long-term strategic objectives set by the hotel chain.

Investments in real estate assets (both in current geographies and in new locations) and property, plant and equipment are very important in this sector, and their financing requires meticulous planning. Therefore, operational and tactical planning must support the hotel chain’s strategic plan, ensuring that each financial decision contributes to sustainable growth and operational efficiency.

How to do good financial planning in hotels.

As in any FP&A process, the starting point is the collection and verification of both internal and external data. This is a very important task, since the plans and estimates that are generated will depend on the quality of this data, and therefore it is a task that can consume a significant amount of time (although we will explain how you can solve this later on).

External factors to take into account for good financial planning in hotels.

For effective financial planning in the hotel sector, it is crucial to consider several external factors, such as:

- Macroeconomic indicators: such as GDP, CPI, currency changes, unemployment rate and global events (such as pandemics) significantly affect demand and financial performance.

- Consumption patterns: market behavior varies over time, and depending on the hotel group’s strategy, it will have to adapt its planning. Luxury or high-price chains, for example, may perform worse than low-cost chains in difficult economic times.

- Market segmentation: the orientation of the hotel (business, tourism, etc.) influences revenues and expenses. For example, hotels aimed at business travelers have a different price sensitivity compared to hotels for families.

- Hotel location: this is also a factor to be taken into account, since a hotel near an airport does not behave in the same way as one located in the center or outskirts of a city.

Internal factors to be taken into account for good financial planning in hotels.

Effective financial planning in hotels is based on proper revenue forecasting and expense management. Here are some key aspects:

Revenues:

- Revenue per room: uses ratios such as ADR (Average Daily Rate), Occupancy Rate, Available Room per Hotel, and RevPAR (Revenue per Available Room) to calculate revenue based on the number of rooms available.

- Additional factors: includes revenues from services such as breakfast (conversion rate and average price), vending and other additional services. It also considers revenues from OTAs (Online Travel Agencies) and their respective costs.

Expenses:

- Variable expenses: calculated in cascade based on revenues, include costs for breakfasts, laundry services, utilities (water, electricity, gas), etc.

- Staff: difference between direct and indirect personnel, using activity-based drivers (season, number of rooms occupied, etc.) to calculate direct personnel costs. Includes salaries, social security costs and other items that may be applicable in this area.

- Common expenses: distribution of expenses such as marketing, taxes and insurance, considering the opening dates of each hotel.

- Fixed expenses: based on the previous year with increases according to macroeconomic indicators, including non-recurring maintenance, security, and subscriptions to services such as WIFI, etc.

- Rents: planned according to rate (fixed, variable) and other specific conditions of the lease agreement.

The amortization of investments and financial expenses is also very relevant in a growth scenario, ensuring that investments are managed in an effective and sustainable manner.

Financial planning software as a solution for hotels

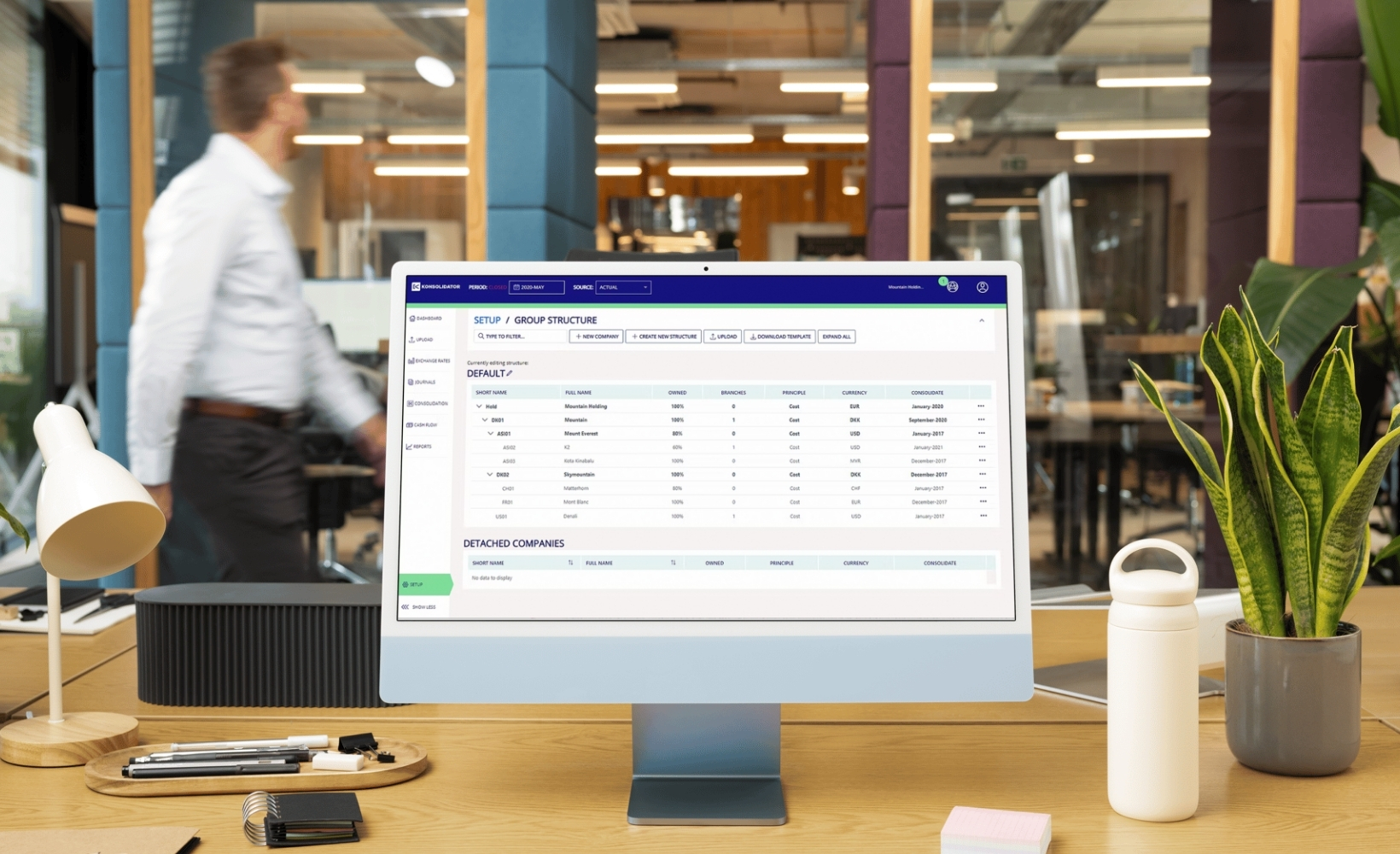

The use of specialized financial planning software for hotels is essential to manage the complexity of these processes in an effective and agile way. Some of the advantages of having this type of solutions include:

- Detail and accuracy: allows detailed planning by hotel, month or week, department and accounting account.

- Collaboration: facilitates a collaborative process involving all departments and people involved in planning.

- Agility in the creation of scenarios: allows to create and compare different scenarios in an agile way.

- Automated tracking: offers comparative tracking capabilities for Actual/Current, Forecast, Budget and Strategic Plan.

- Control and traceability: provides tools for the control, traceability and monitoring of budget execution through workflow and validation processes.

Implementing the right FP&A software allows hotels to optimize their financial planning and respond quickly to market changes, thus improving strategic decision making.

Holistic Data Solutions: tailor-made financial software solutions for hotels.

Financial planning and analysis (FP&A) is essential for success and sustainability in the hotel industry. With the ability to adapt quickly to market changes and the implementation of advanced planning tools, hotels can optimize their operations and ensure sustained growth.

If you would like to learn more about how Holistic Data Solutions can help you with its FP&A software and transform your hotel’s financial management, please do not hesitate to contact us. Our team of experts will be happy to help you.

Related Articles

In a context like the current one where financial instability and market volatility are so present, it is normal that [...]

Board International was founded in the 1990s with the aim of being a Self-Service Analysis and Reporting, which goes through [...]

Time and money. If we were to carry out a market survey and ask finance directors, entrepreneurs or heads of [...]